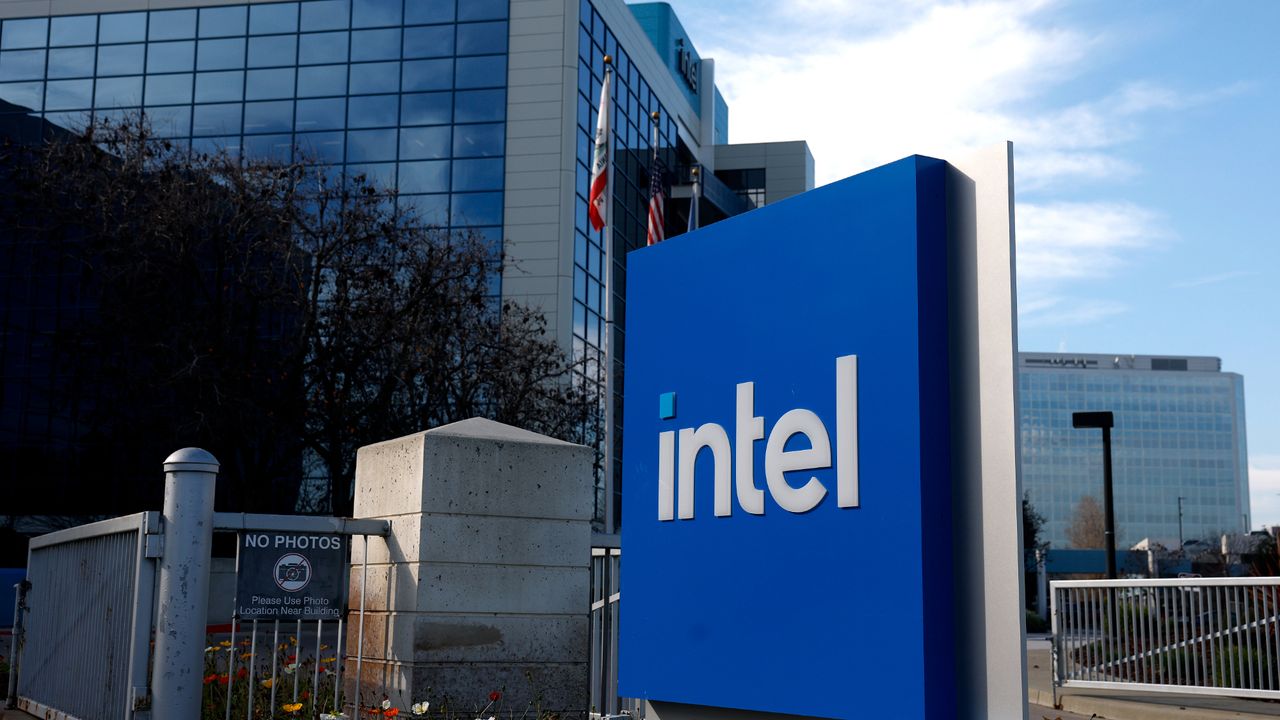

Intel shares down 13% as company only manages to shrink losses in latest earnings, demand to outpace 2026 supply — $300 million deficit comes despite more than $20 billion in outside investment from Nvidia and friends

💡

Verdict: Despite stabilizing in 2025 and strong Q4 results, Intel anticipates supply constraints in Q1 2026, impacting investors and causing a stock dip.

⚡ Quick Hits

- Intel's stock price dropped significantly (13%) following the earnings report.

- The company anticipates supply issues in early 2026, even with substantial external investments.

- Q4 results were positive, indicating a period of stabilization in 2025.

Intel Faces Supply Constraints in 2026, Stock Dips

Intel's management successfully navigated the company towards stabilization in 2025. However, after a strong Q4 performance, Intel is now projecting supply constraints for Q1 2026. This news has negatively impacted investor confidence, resulting in a 13% drop in Intel's stock price. The company anticipates demand will exceed supply despite significant investments. The report indicates a $300 million deficit, even with $20 billion in investments.

*Source Intel: Read Original*